Open Enrollment: Benefits to Opt-In for your HSA

HSA can offer “triple tax benefits”: tax-free contributions, tax-free earnings, and tax-free distributions.

September is the Best Tax Planning Month. Yes, really.

Reconcile tax planning strategies for the current year while positioning for the year ahead.

Your Teen Working This Summer? Fund Their Roth IRA.

Roth IRA for Kids can save for retirement, qualified educational expenses and introduce personal investing.

New Dependent Care FSA Changes Provide Tax Savings

A family with childcare in 24% tax bracket may save an extra $1,980 in taxes due to new legislation, but must act now.

If your taxes could talk, what would they say?

Your just completed taxes are telling you how to save money in 2021 and beyond, are you listening?

Zoom Your Estate Planning

Technology and legislation are removing procrastination from developing your holistic estate plan.

2020 - The Worst Year Ever… Really?

Turn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Closing Time for 2020

There are investing, tax planning, and retirement planning opportunities to be had before year-end.

Why worry or fight? Have the money talks without the walk.

How to have open discussions about finances for a healthy relationship.

To Convert or Not To Convert: Taxation Is The Question

Think your taxes or tax rate will be higher in retirement? Consider a Roth Conversion strategy.

Would’ve, Could’ve, Should’ve… But Did You?

Instead of talk of the future, act on the constants - change and time.

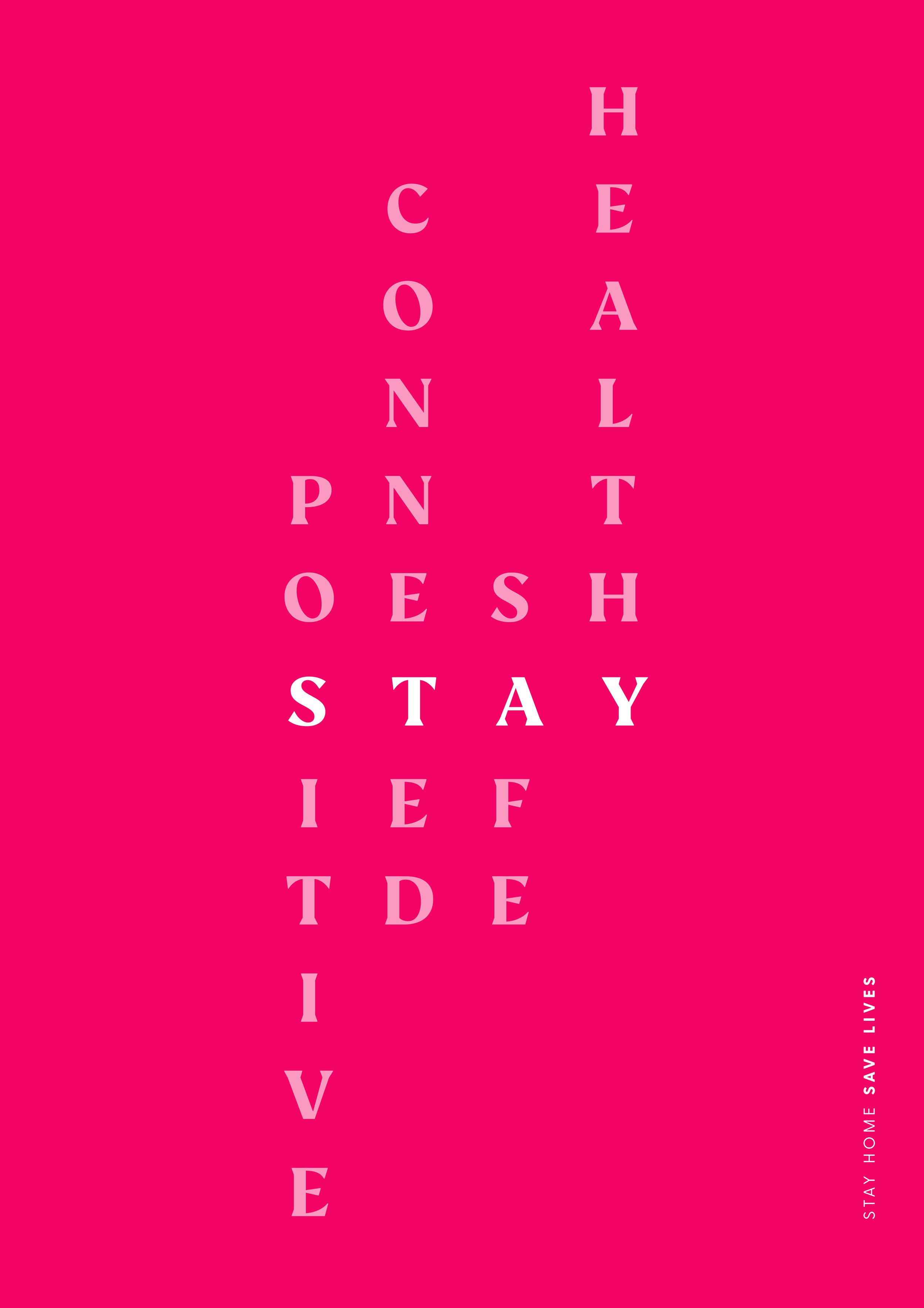

Proactive Planning and Health Remain Critical

Putting off your health or planning over fear isn’t the “new normal”.