Top 10% earners in their 30’s and 40’s believe they’ll earn considerably more in their 50’s. Don’t plan on it.

Read MoreResolutions to improve your financial situation similar to one’s made last year? Here’s how and why to consider actions and timeframes, instead of focusing on desired outcomes.

While 2022 has been a challenging investment environment, it has been a fantastic year to see the benefits of executing financial plans over the past few years.

Read MoreOver past year, health insurance prices have increased 3X to US inflation. It’s time to fully understand HDHP, HSA and how to do your cost/benefit analysis.

Take control, don’t be another victim to make your teen happy… spending won’t make them happy.

Read MoreOr Not!

MA House Speaker Ronald Mariano explains how MA legislature failed to pass an economic development plan which included changing outdated estate tax laws that just days before had the support of both the Democratic Senate and House, in addition support from Republican Governor Charlie Baker.

Read MoreThis month celebrates those caring for their young children and aging parents simultaneously - Sandwichers.

Read MoreFinancial literacy doesn’t equate to understanding value or making good, responsible decisions.

Read MoreMy PSA for those adhering to a financial plan: Book your travel now.

Read MoreThe news of Congress limiting Roth IRA conversions and eliminating Backdoor Roth? Never mind (for now).

How to make financial resolutions that lead to successful planning outcomes.

Read MoreAction items based upon the old adage “Inflation rewards debtors and hurts creditors”.

Read MoreRoth IRA for Kids can save for retirement, qualified educational expenses and introduce personal investing.

Read MoreMay be good reasons to change jobs or quit, best to remove emotions and seek validation before resignation.

Read MoreTurn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Read MoreCollege Planning is more than 529s and student loans, focus on how to take less of each.

Read MoreHow to have open discussions about finances for a healthy relationship.

Read MoreUse money as a tool, over time you’ve viewed as the sum of their experiences.

Read MoreInstead of talk of the future, act on the constants - change and time.

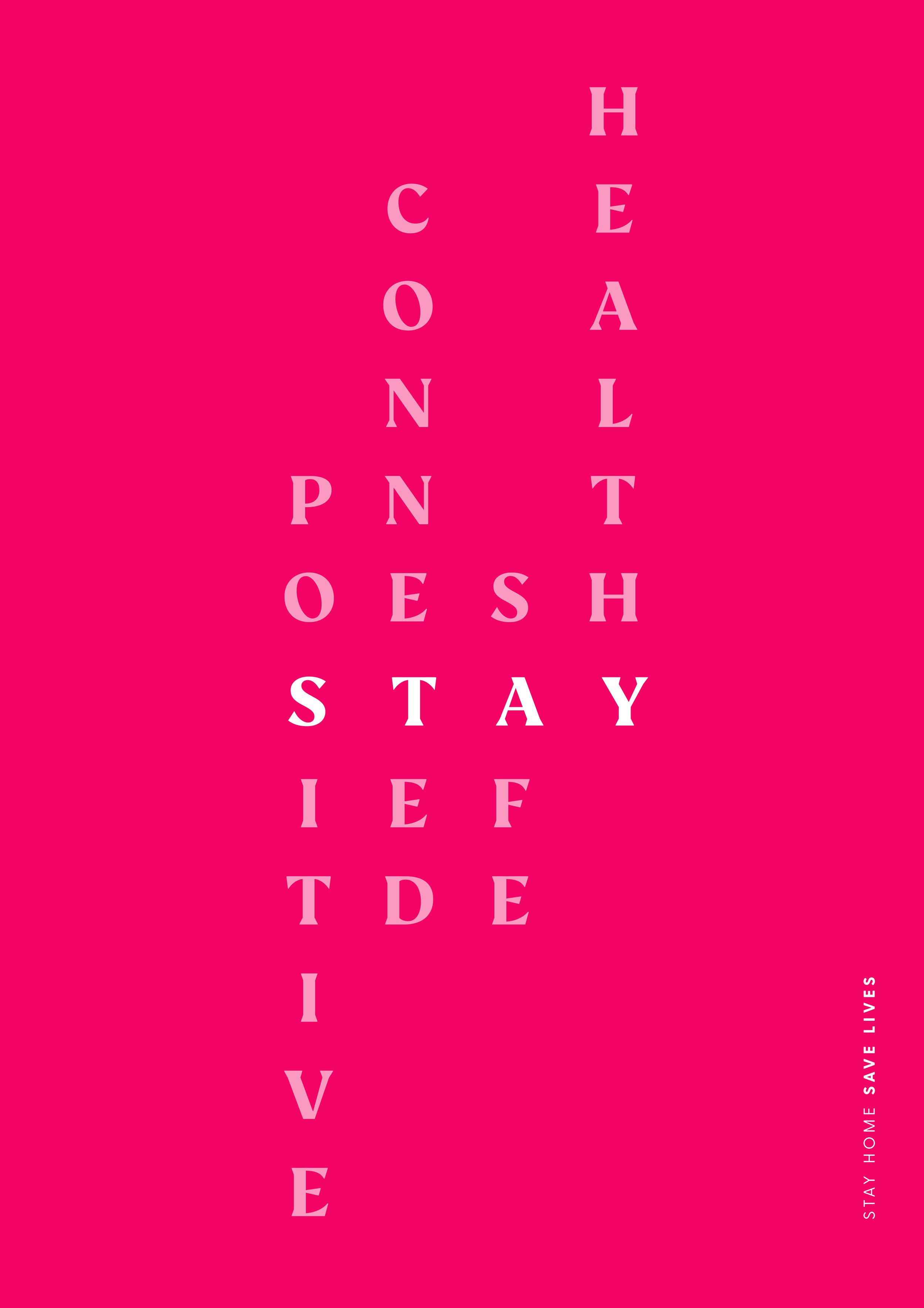

Read MorePutting off your health or planning over fear isn’t the “new normal”.

Read More