While cash or gift cards are always appreciated, consider something with lasting value that can help launch college and high school graduates towards financial independence.

Read MoreRetirees view risks differently, but the greatest risk is behavioral. Let’s discuss a sustainable and tax-efficient approach to retirement distribution strategies.

Read MoreIRS steps in and delays an important aspect of Secure Act 2.0 passed by Congress last December.

Read MoreNow that you’ve had some time apart, it’s time to have an honest with your taxes.

Read MoreTop 10% earners in their 30’s and 40’s believe they’ll earn considerably more in their 50’s. Don’t plan on it.

Read MoreSequels aren’t always a good thing, yet Congress has brought Secure Act 2 - reviewing the good, bad, and breakin’ star.

Read MoreResolutions to improve your financial situation similar to one’s made last year? Here’s how and why to consider actions and timeframes, instead of focusing on desired outcomes.

While 2022 has been a challenging investment environment, it has been a fantastic year to see the benefits of executing financial plans over the past few years.

Read MoreA year-end strategy to consider for turning lemons into lemonade is Roth Conversion.

Read MoreIf your wealth is tax-deferred retirement accounts, your taxes in retirement will be more than you realize.

Read MoreThe news of Congress limiting Roth IRA conversions and eliminating Backdoor Roth? Never mind (for now).

Reconcile tax planning strategies for the current year while positioning for the year ahead.

Read MoreRoth IRA for Kids can save for retirement, qualified educational expenses and introduce personal investing.

Read MoreTurn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Read MoreThere are investing, tax planning, and retirement planning opportunities to be had before year-end.

Read MoreThink your taxes or tax rate will be higher in retirement? Consider a Roth Conversion strategy.

Read MoreInstead of talk of the future, act on the constants - change and time.

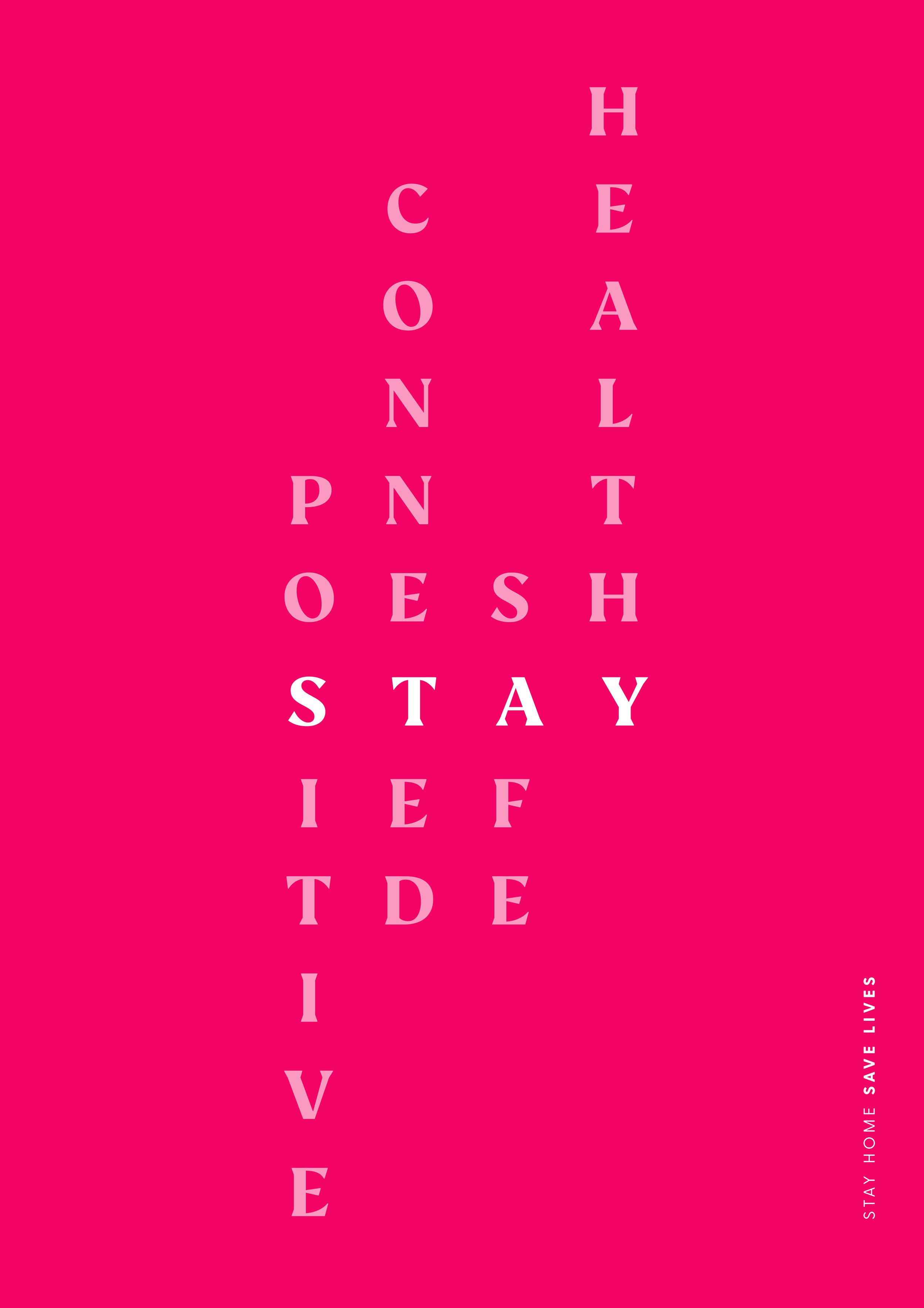

Read MorePutting off your health or planning over fear isn’t the “new normal”.

Read MoreBig picture opportunities for 3 RE’s: Refinance, Rebalance and Reset.

Read MoreNew 10-Year Rule eliminates waiting for taxes and forces assets out of Roth IRAs.

Read More