Open Enrollment: Medical Plans & Health Savings Accounts (HSA)

Open enrollment can be perplexing for many is analyzing High Deductible Health Plans (HDHP) and their tax savings counterpart, Health Savings Accounts (HSAs).

At or Near Retirement? Time to Say Bucket!

Retirees view risks differently, but the greatest risk is behavioral. Let’s discuss a sustainable and tax-efficient approach to retirement distribution strategies.

Eye Opening Costs At Open Enrollment?

Over past year, health insurance prices have increased 3X to US inflation. It’s time to fully understand HDHP, HSA and how to do your cost/benefit analysis.

Open Enrollment: Benefits to Opt-In for your HSA

HSA can offer “triple tax benefits”: tax-free contributions, tax-free earnings, and tax-free distributions.

Take this job and shove it!? Measure twice, cut once.

May be good reasons to change jobs or quit, best to remove emotions and seek validation before resignation.

Would’ve, Could’ve, Should’ve… But Did You?

Instead of talk of the future, act on the constants - change and time.

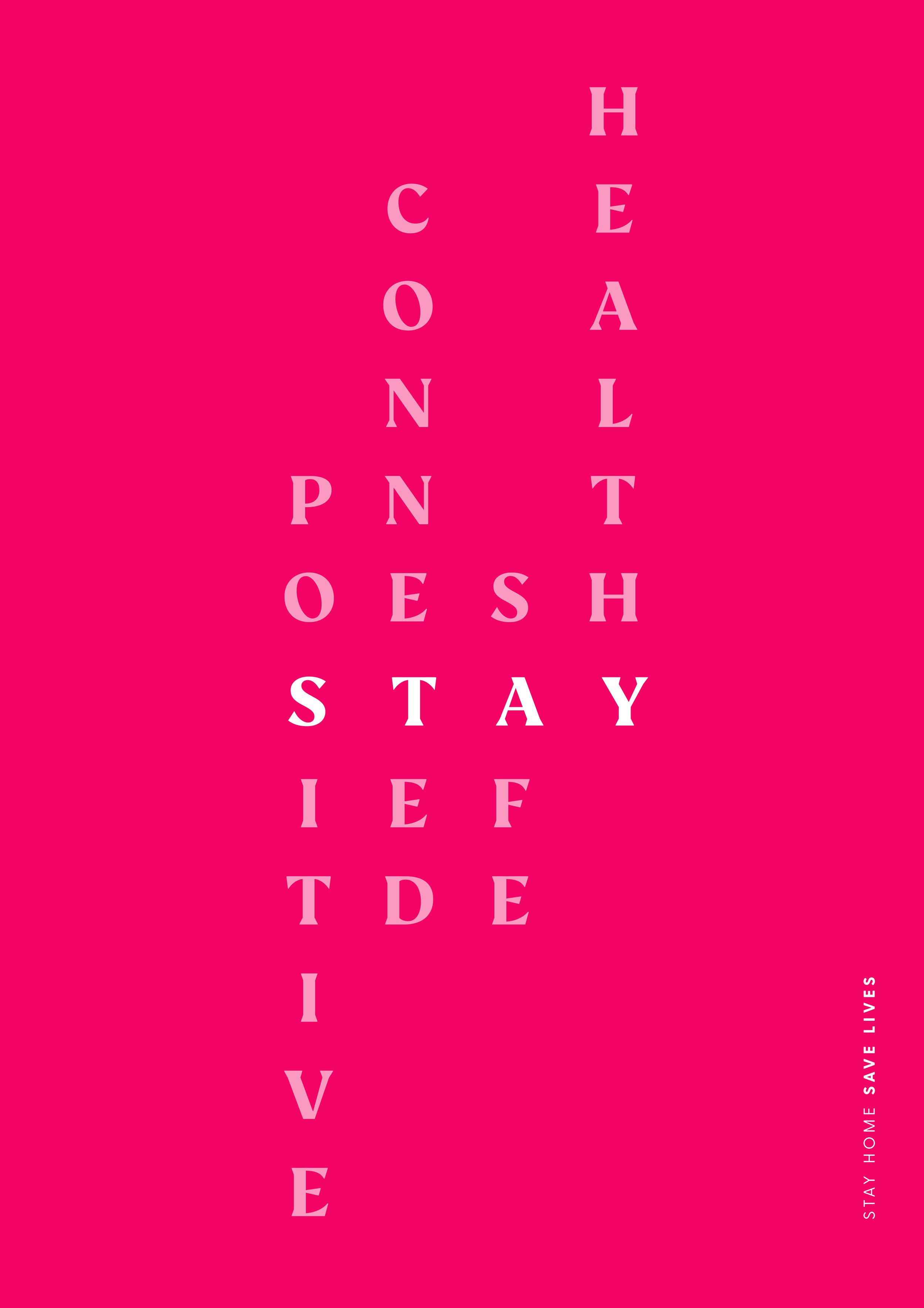

Proactive Planning and Health Remain Critical

Putting off your health or planning over fear isn’t the “new normal”.