Homebuying in March: A Smart Time to Make Your Move?

March signals the beginning of homebuying season, but before scrolling Zillow, open houses, and finding a real estate agent, let’s discuss things you need to implement.

Ready Homebuyers? The Fed’s New “No Urgency” Mantra Is A Gift.

If one waits for 5% mortgages, there are considerable opportunity costs. Potential homebuyers should prepare to act by utilizing these tools and best practices.

At or Near Retirement? Time to Say Bucket!

Retirees view risks differently, but the greatest risk is behavioral. Let’s discuss a sustainable and tax-efficient approach to retirement distribution strategies.

Frugal February… A Different Take, One That’s Sustainable.

Many use Frugal February as a month to not spend. While noble, how sustainable is this for improved outcomes Instead, let’s discuss actions that provide yearlong benefits plus a better time to start.

Establish Access When Things Are Good, Not When Times Turn Bad

Benefits of having a HELOC with $0 balance go far beyond a potential home renovation.

Resolutions Gone Bad: Rein In Your New Year.

How to make financial resolutions that lead to successful planning outcomes.

Inflation: Increase assets, borrow, and lock in debits.

Action items based upon the old adage “Inflation rewards debtors and hurts creditors”.

2020 - The Worst Year Ever… Really?

Turn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Would’ve, Could’ve, Should’ve… But Did You?

Instead of talk of the future, act on the constants - change and time.

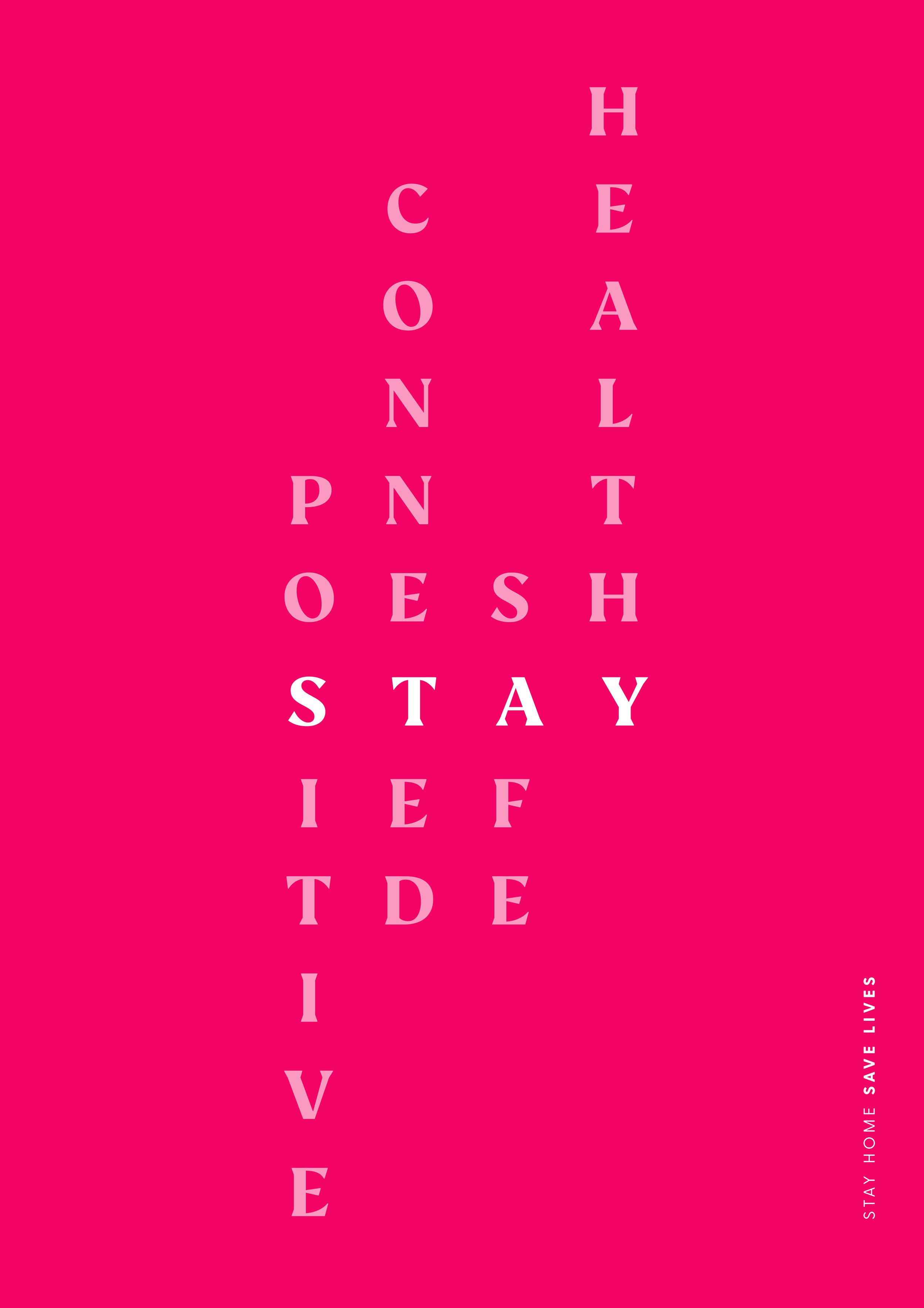

Proactive Planning and Health Remain Critical

Putting off your health or planning over fear isn’t the “new normal”.