Portfolios Care About Asset Allocation, Not Your Emotions.

While the cause of volatility changes, a constant remains - portfolios don't care about your feelings.

Homebuying in March: A Smart Time to Make Your Move?

March signals the beginning of homebuying season, but before scrolling Zillow, open houses, and finding a real estate agent, let’s discuss things you need to implement.

Ready Homebuyers? The Fed’s New “No Urgency” Mantra Is A Gift.

If one waits for 5% mortgages, there are considerable opportunity costs. Potential homebuyers should prepare to act by utilizing these tools and best practices.

You Can’t Always Get What You Want… But If You Try Sometimes

With markets All Down The Line, thinking it will make you Happy to become Exile on Wall St?

Inflation: Increase assets, borrow, and lock in debits.

Action items based upon the old adage “Inflation rewards debtors and hurts creditors”.

Tax Loss Harvesting: Give Thanks And Slice Your Pie

Losing investments can offset realized profits as well as up to $3,000 in non-investment income each year.

Take this job and shove it!? Measure twice, cut once.

May be good reasons to change jobs or quit, best to remove emotions and seek validation before resignation.

Rising Rates, Sinking Values: Are Bonds Dead?

Since 1976 the bond market has been negative just 3 times, 2021 could be the fourth and worst.

Revisiting - Dividends: Evolve Beyond Yield

Revisiting the conundrum for income investors in today’s low-interest rate environment.

2020 - The Worst Year Ever… Really?

Turn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Would’ve, Could’ve, Should’ve… But Did You?

Instead of talk of the future, act on the constants - change and time.

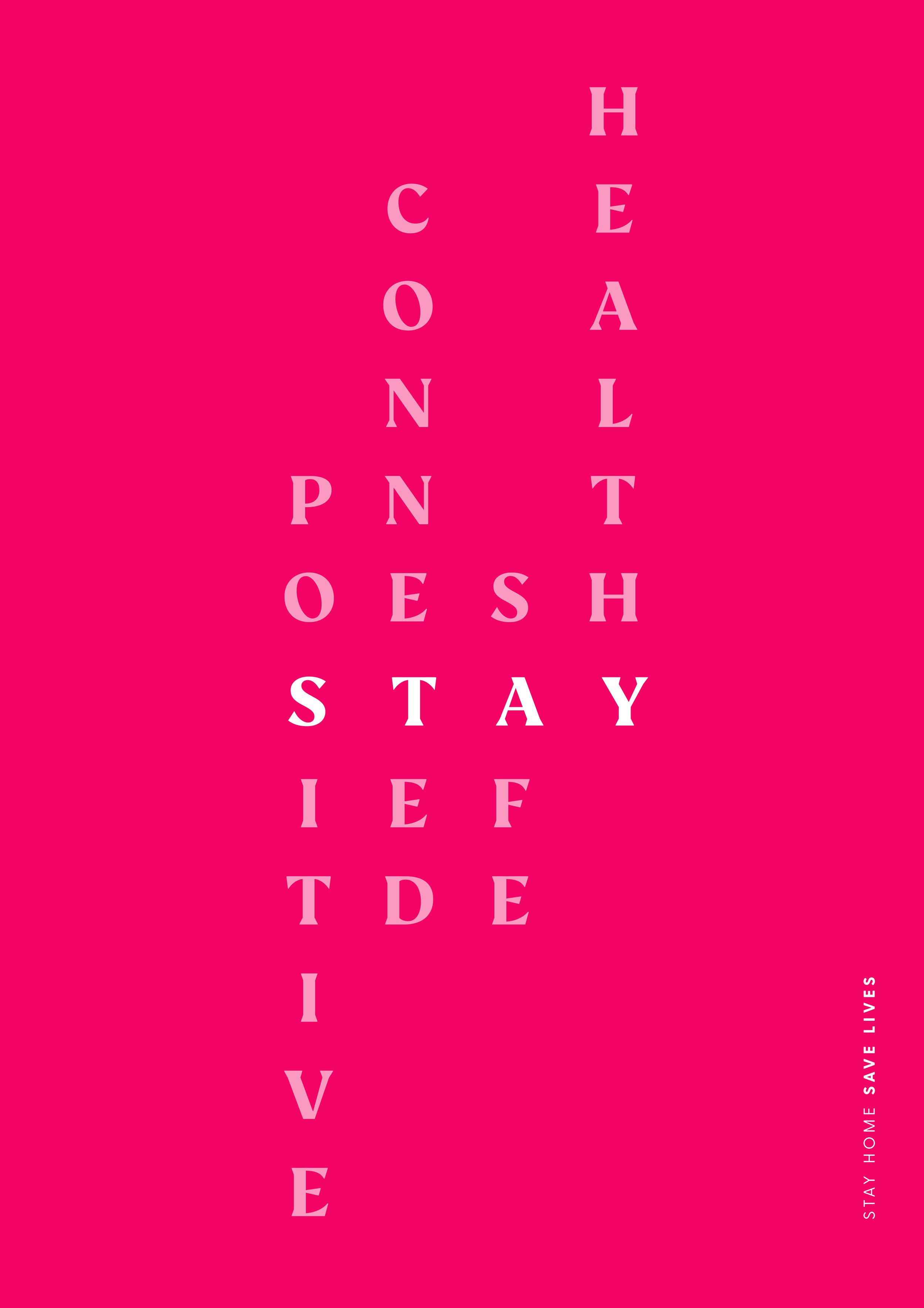

Proactive Planning and Health Remain Critical

Putting off your health or planning over fear isn’t the “new normal”.