Homebuying in March: A Smart Time to Make Your Move?

March signals the beginning of homebuying season, but before scrolling Zillow, open houses, and finding a real estate agent, let’s discuss things you need to implement.

Ready Homebuyers? The Fed’s New “No Urgency” Mantra Is A Gift.

If one waits for 5% mortgages, there are considerable opportunity costs. Potential homebuyers should prepare to act by utilizing these tools and best practices.

Enjoy Every Sandwicher Moment.

This month celebrates those caring for their young children and aging parents simultaneously - Sandwichers.

Resolutions Gone Bad: Rein In Your New Year.

How to make financial resolutions that lead to successful planning outcomes.

Inflation: Increase assets, borrow, and lock in debits.

Action items based upon the old adage “Inflation rewards debtors and hurts creditors”.

Take this job and shove it!? Measure twice, cut once.

May be good reasons to change jobs or quit, best to remove emotions and seek validation before resignation.

2020 - The Worst Year Ever… Really?

Turn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Would’ve, Could’ve, Should’ve… But Did You?

Instead of talk of the future, act on the constants - change and time.

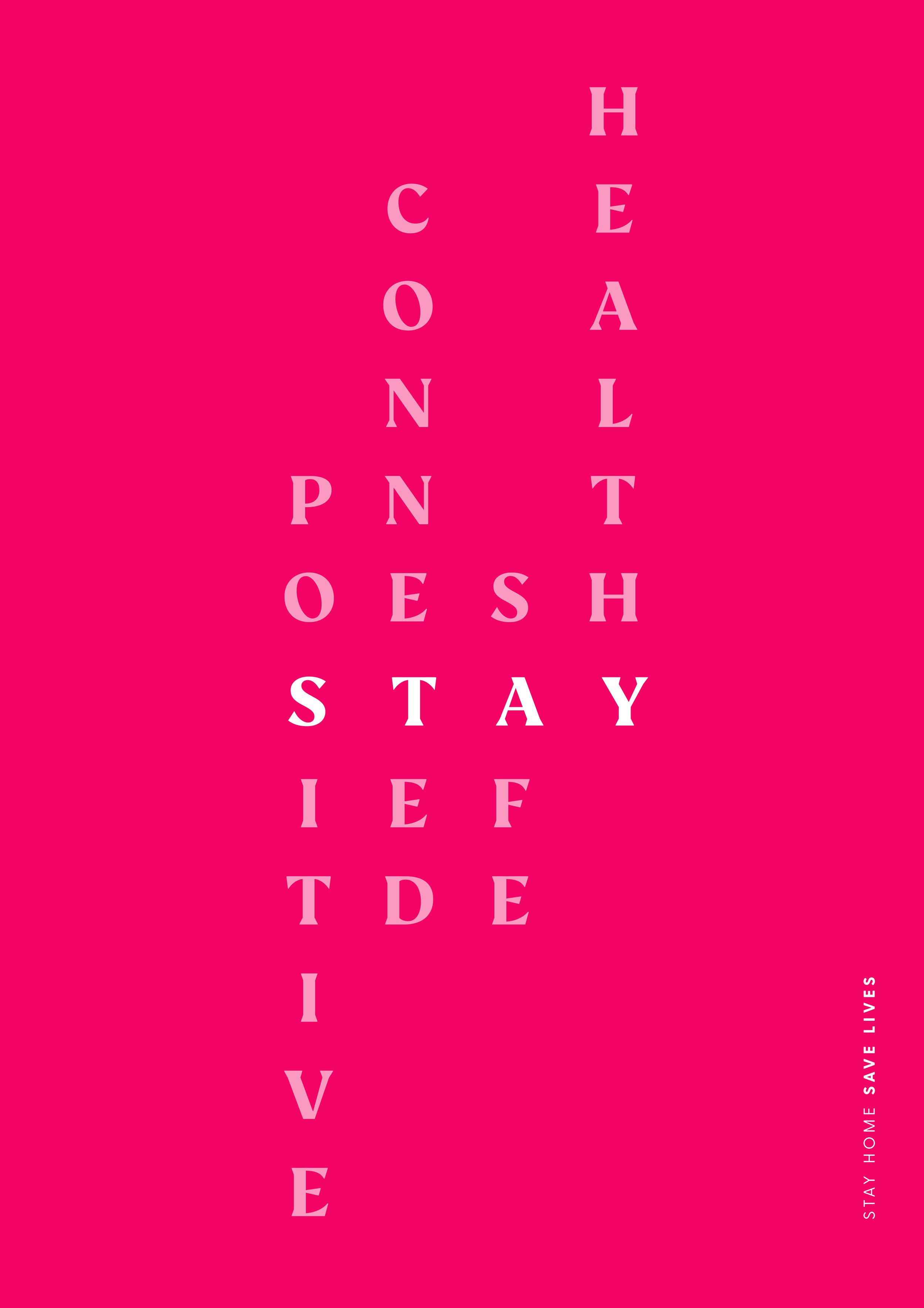

Proactive Planning and Health Remain Critical

Putting off your health or planning over fear isn’t the “new normal”.

Ch-Ch-Changes - Turn And Face The Strange

CARES Act legislation impacting 2020 tax laws, provisions and deadlines.

Be Proactive and Less Reactive

Big picture opportunities for 3 RE’s: Refinance, Rebalance and Reset.

Ten Years Gone: People Evolve, Plans Should Too.

A plan is not a buy-and-hold investment, it needs to be dynamic as you evolve.