Battle of The Ages: Wealth Effect vs. Experience Spending

Negative wealth effect causes people to reduce spending, not only on luxuries but also meaningful, joyful experiences. But should it?

Ready Homebuyers? The Fed’s New “No Urgency” Mantra Is A Gift.

If one waits for 5% mortgages, there are considerable opportunity costs. Potential homebuyers should prepare to act by utilizing these tools and best practices.

At or Near Retirement? Time to Say Bucket!

Retirees view risks differently, but the greatest risk is behavioral. Let’s discuss a sustainable and tax-efficient approach to retirement distribution strategies.

The Clash Against The Magnificent Seven

The Magnificent Seven have gained 71% this year while the other 493 stocks in the S&P 500 have gained just 6%.

Financial Aid Changes To Impact This Fall’s College Applications.

Congress has created the “FAFSA Simplification Act”, which makes the upcoming 2024-2025 college admissions process a complicated mess.

Never ask, “Where do you want to go to college?”

Take control, don’t be another victim to make your teen happy… spending won’t make them happy.

Inflation: Increase assets, borrow, and lock in debits.

Action items based upon the old adage “Inflation rewards debtors and hurts creditors”.

Take this job and shove it!? Measure twice, cut once.

May be good reasons to change jobs or quit, best to remove emotions and seek validation before resignation.

2020 - The Worst Year Ever… Really?

Turn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Would’ve, Could’ve, Should’ve… But Did You?

Instead of talk of the future, act on the constants - change and time.

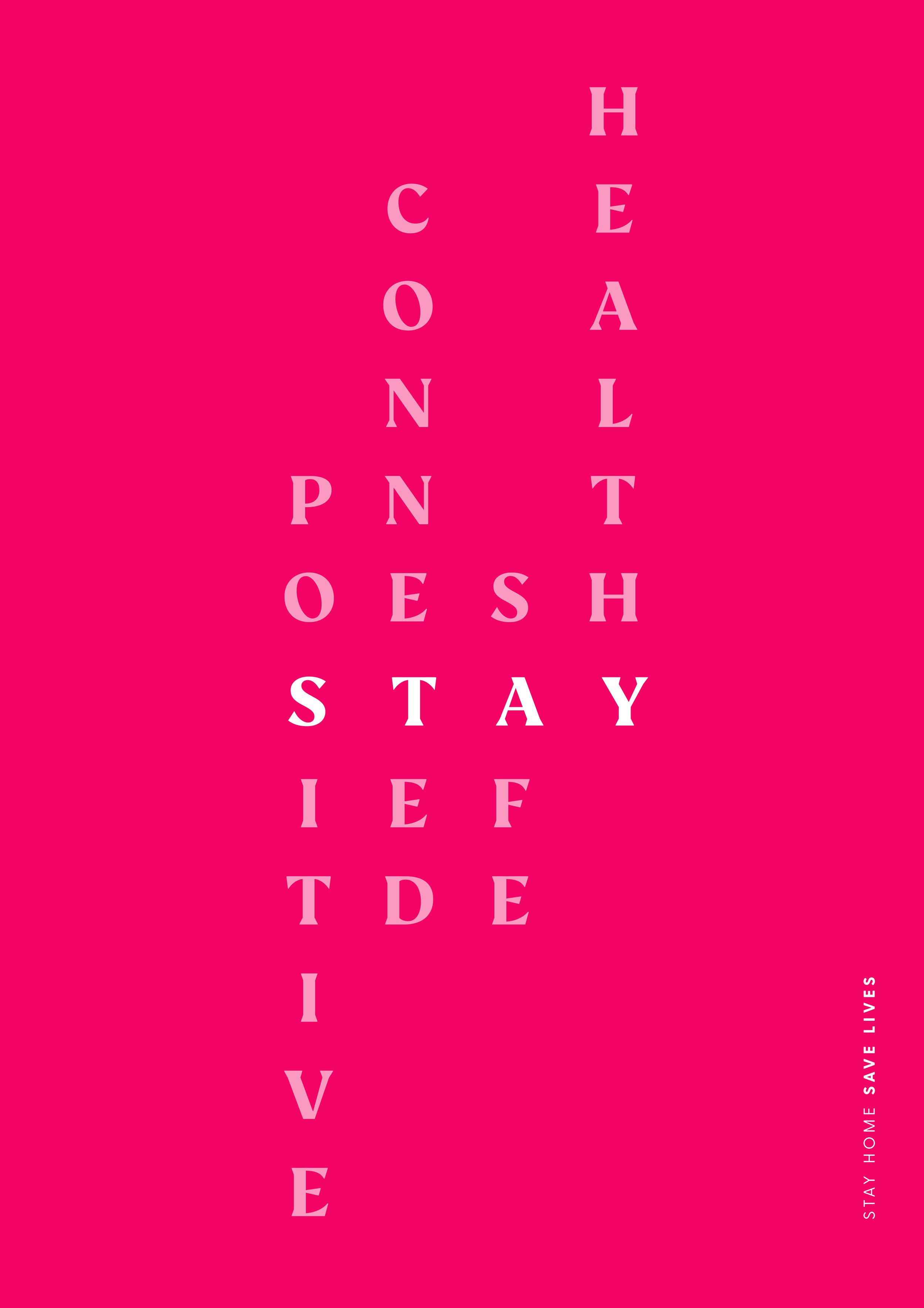

Proactive Planning and Health Remain Critical

Putting off your health or planning over fear isn’t the “new normal”.

Ch-Ch-Changes - Turn And Face The Strange

CARES Act legislation impacting 2020 tax laws, provisions and deadlines.