Mastering the College Admissions Process

Understanding nuances of early action and early decision, exploring merit-based aid, and utilizing 529 plans and loans effectively can impact you and your stressed college-bound teen's journey.

Empower New Graduates with Gifts of Independence

While cash or gift cards are always appreciated, consider something with lasting value that can help launch college and high school graduates towards financial independence.

If You Fail To Plan, You Are Planning To Fail.

Starting the New Year with the same old resolutions? Let’s recognize questionable resolutions, including three destined for failure, plus what should be considered for successful planning outcomes.

Financial Aid Changes To Impact This Fall’s College Applications.

Congress has created the “FAFSA Simplification Act”, which makes the upcoming 2024-2025 college admissions process a complicated mess.

New Year, New You… Not True?

Resolutions to improve your financial situation similar to one’s made last year? Here’s how and why to consider actions and timeframes, instead of focusing on desired outcomes.

Never ask, “Where do you want to go to college?”

Take control, don’t be another victim to make your teen happy… spending won’t make them happy.

2020 - The Worst Year Ever… Really?

Turn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Your HS Junior know EFC, NPC or Merit? They should.

College Planning is more than 529s and student loans, focus on how to take less of each.

Would’ve, Could’ve, Should’ve… But Did You?

Instead of talk of the future, act on the constants - change and time.

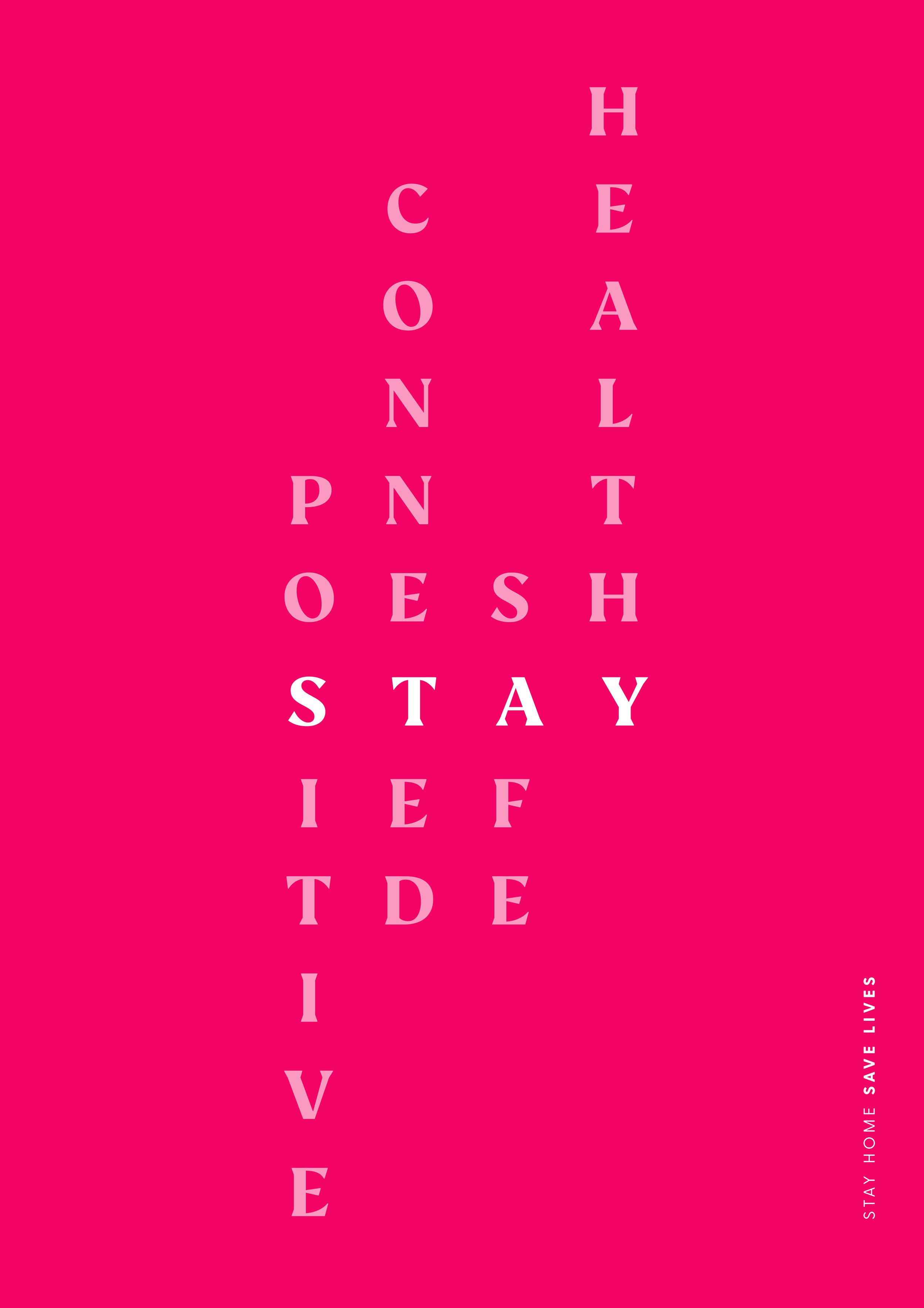

Proactive Planning and Health Remain Critical

Putting off your health or planning over fear isn’t the “new normal”.

Ch-Ch-Changes - Turn And Face The Strange

CARES Act legislation impacting 2020 tax laws, provisions and deadlines.

Be Proactive and Less Reactive

Big picture opportunities for 3 RE’s: Refinance, Rebalance and Reset.