Would’ve, Could’ve, Should’ve… But Did You?

Instead of talk of the future, act on the constants - change and time.

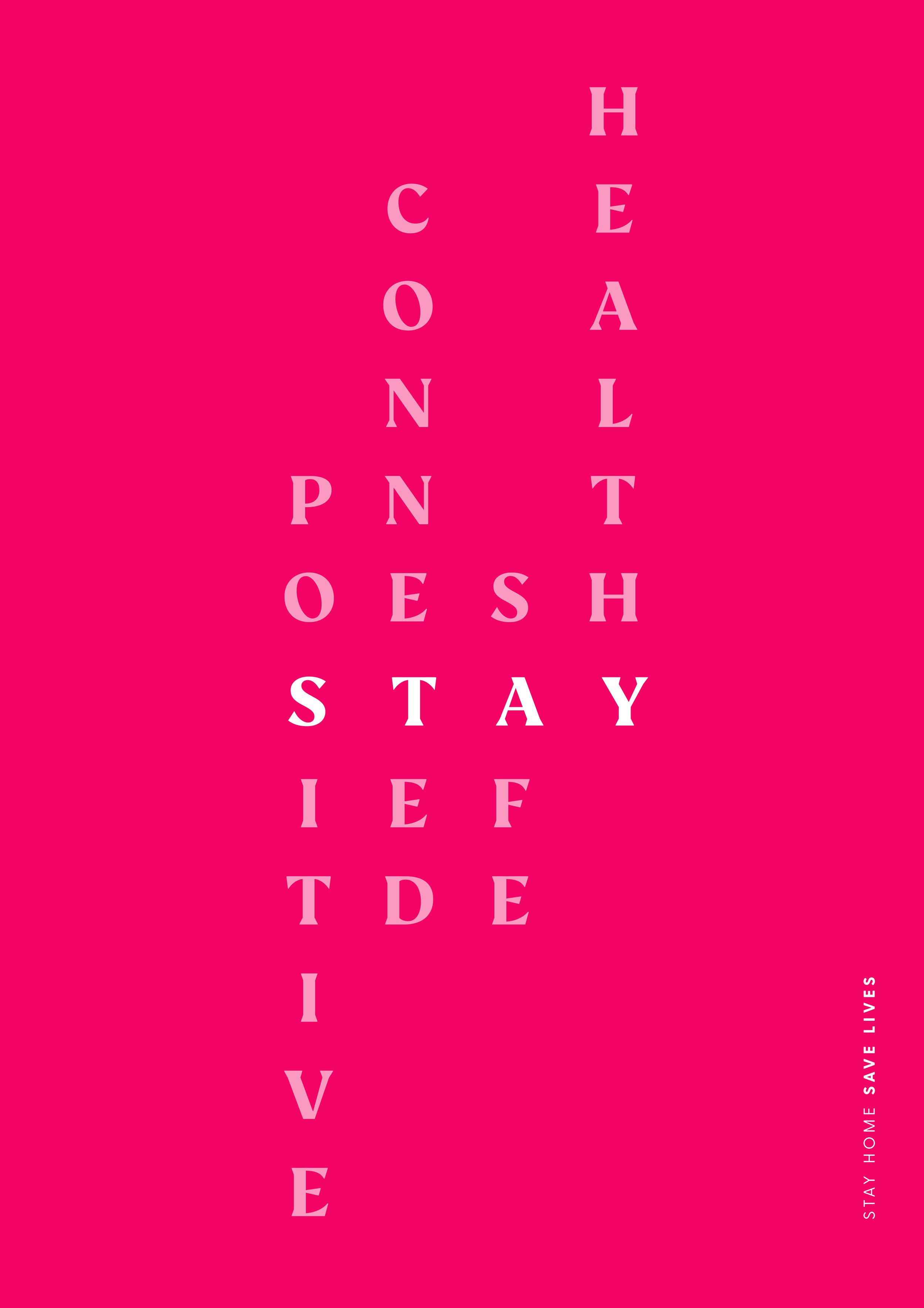

Proactive Planning and Health Remain Critical

Putting off your health or planning over fear isn’t the “new normal”.

Ch-Ch-Changes - Turn And Face The Strange

CARES Act legislation impacting 2020 tax laws, provisions and deadlines.

Be Proactive and Less Reactive

Big picture opportunities for 3 RE’s: Refinance, Rebalance and Reset.

Ten Years Gone: People Evolve, Plans Should Too.

A plan is not a buy-and-hold investment, it needs to be dynamic as you evolve.

Are you a Sandwicher? Embrace it!

In planning for 3 generations, ways to embrace communication and change.

Lists for sun, fun and rainy day funds.

Define your needs, seeds, wants and “what was I thinking?!”.

Teaching Your Kids About Money

Fun ways to embrace budgeting, power of saving & philanthropy.

Outlooks for 2019, Do They Matter?

New year, new positioning. The investment community loves annual outlooks. Do you act or let them become part of your past, like Sears Wish Books?

HSA & HDHP - Alphabet Soup of Work Benefits

Work benefits are complicated, including High Deductible Health Plans (HDHP). Health Savings Accounts (HSA) can be utilized to your advantage for savings and tax planning.