The news of Congress limiting Roth IRA conversions and eliminating Backdoor Roth? Never mind (for now).

How to make financial resolutions that lead to successful planning outcomes.

Read MoreAction items based upon the old adage “Inflation rewards debtors and hurts creditors”.

Read MoreLosing investments can offset realized profits as well as up to $3,000 in non-investment income each year.

Read MoreHSA can offer “triple tax benefits”: tax-free contributions, tax-free earnings, and tax-free distributions.

Read MoreReconcile tax planning strategies for the current year while positioning for the year ahead.

Read MoreRoth IRA for Kids can save for retirement, qualified educational expenses and introduce personal investing.

Read MoreA family with childcare in 24% tax bracket may save an extra $1,980 in taxes due to new legislation, but must act now.

Read MoreYour just completed taxes are telling you how to save money in 2021 and beyond, are you listening?

Read MoreTechnology and legislation are removing procrastination from developing your holistic estate plan.

Turn down the hyperbole, 2020 offered great opportunities to refinance, save, invest, WFH, and focus on your why.

Read MoreThere are investing, tax planning, and retirement planning opportunities to be had before year-end.

Read MoreHow to have open discussions about finances for a healthy relationship.

Read MoreThink your taxes or tax rate will be higher in retirement? Consider a Roth Conversion strategy.

Read MoreInstead of talk of the future, act on the constants - change and time.

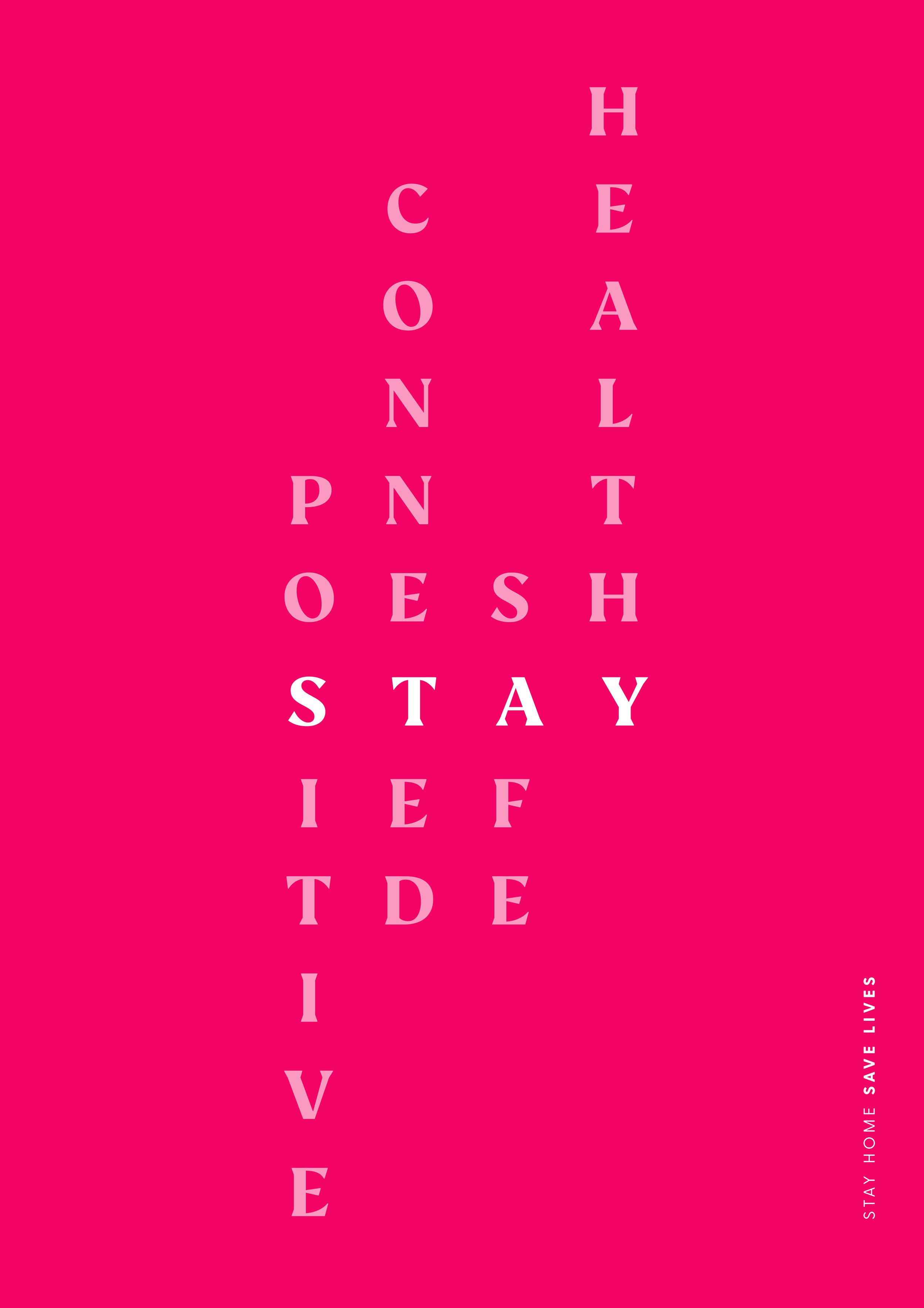

Read MorePutting off your health or planning over fear isn’t the “new normal”.

Read MoreCARES Act legislation impacting 2020 tax laws, provisions and deadlines.

Read MoreBig picture opportunities for 3 RE’s: Refinance, Rebalance and Reset.

Read MoreCan a low dividend yield be more favorable over the long-term?

Read MoreNew 10-Year Rule eliminates waiting for taxes and forces assets out of Roth IRAs.

Read More